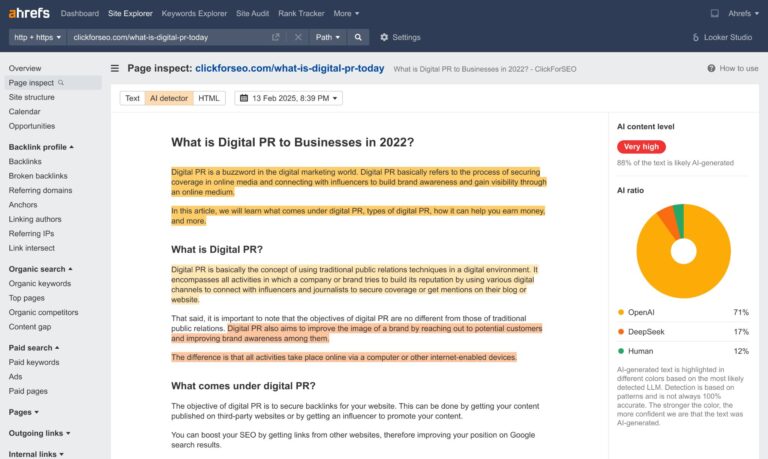

The global enterprise networking market is undergoing a structural shift as Secure Access Service Edge continues to displace traditional access routers at an accelerating pace. New data from Dell’Oro Group shows that the SASE market expanded 21 percent year over year in the third quarter of 2025, reaching nearly $3 billion in revenue, while spending on legacy access routers fell sharply by 25 percent during the same period.

The contrasting trajectories illustrate how enterprises are rapidly reallocating budgets away from hardware-centric connectivity toward cloud-delivered networking and security platforms.

Dell’Oro Group, a long-established research firm covering telecommunications, networking, security, and data center infrastructure, reports that SASE is increasingly becoming the default architecture for branch offices, remote workers, and cloud access. Rather than replacing access routers on a one-for-one basis, enterprises are aligning branch refresh cycles with broader Zero Trust and SASE initiatives, accelerating the decline of traditional edge hardware.

Well-known global suppliers of Security Service Edge (SSE) and SASE solutions include Netskope, Zscaler, Palo Alto Networks, Cisco, Fortinet, Cato Networks and Cloudflare.

Industry analysts note that the conversation among enterprise buyers has shifted decisively. Organizations are no longer debating whether networking and security should be converged; instead, they are focused on how quickly they can migrate funding and operational models away from access routers and toward unified platforms that deliver both capabilities as a service. The more than 40 percentage-point gap between SASE growth and access router decline underscores how rapidly enterprise edge architectures are being redesigned.

Competitive dynamics within the SASE market remain intense. In the third quarter, Zscaler, Cisco, and Palo Alto Networks emerged as the top three vendors by revenue, with less than a one percentage-point difference separating the top two. This narrow margin highlights both the maturity of the market and the strategic importance of SASE portfolios to major networking and security providers.

Security Service Edge continues to play a critical role in SASE adoption. Dell’Oro Group reports that SSE revenue grew 20 percent year over year and now represents nearly one-third of total SASE revenue. For many enterprises, cloud-delivered security services such as secure web gateways, zero trust network access, and cloud access security brokers remain the primary entry point into broader SASE deployments.

On the networking side, SD-WAN revenue increased 23 percent year over year, reflecting sustained demand as organizations modernize branch connectivity to support hybrid work, cloud applications, and application-aware traffic management. Rather than extending the lifespan of access routers, enterprises are integrating SD-WAN into SASE frameworks to simplify operations and reduce architectural complexity.

Looking ahead, Dell’Oro Group anticipates that strong demand will continue to drive double-digit growth in the SASE market through 2026. Since the firm began tracking the segment in 2019, total market growth is projected to approach 500 percent, reinforcing the view that SASE is no longer an emerging trend but a foundational enterprise networking model.

Executive Insights FAQ

What is driving the decline in access router spending?

Enterprises are shifting budgets from hardware-based connectivity to cloud-delivered platforms that combine networking and security in a single architecture.

Why is SASE growing so rapidly?

SASE aligns with hybrid work, cloud adoption, and Zero Trust strategies, offering scalable access and security without relying on legacy branch hardware.

Which vendors are leading the SASE market?

Zscaler, Cisco, and Palo Alto Networks currently lead by revenue, with competition among top providers remaining very close.

What role does Security Service Edge play in SASE adoption?

SSE often serves as the entry point for enterprises, enabling cloud-based security controls that can later expand into full SASE deployments.

What is the long-term outlook for SASE?

Analysts expect sustained double-digit growth, positioning SASE as the dominant enterprise edge architecture through the rest of the decade.