Lumen Technologies has completed the $5.75 billion sale of its Mass Markets fiber-to-the-home (FTTH) business, which includes Quantum Fiber, to AT&T. The cash deal – subject to working capital and purchase price adjustments – covers operations in 11 U.S. states and marks a pivotal moment in Lumen’s ongoing transformation into a next-generation enterprise digital networking provider.

The agreement transfers more than four million fiber enablements and nearly one million Quantum Fiber customers to AT&T as of March 31, 2025. According to Lumen’s Q1 2025 metrics, these accounts contribute over $750 million in annual revenue. With the sale finalized, Lumen intends to significantly refocus on its enterprise business while preserving the foundational infrastructure assets critical to that strategy.

“This is a once-in-a-generation opportunity, we’re building a digital networking business that supports today’s AI demands and will be ready for quantum computing tomorrow,” said Kate Johnson.Kate Johnson, Lumen’s president and CEO, described the transaction as a strategic move that aligns with the company’s long-term vision. “We are focusing more on enterprise clients, and this deal increases our financial flexibility, allowing us to reimagine networking for enterprises in a multi-cloud, AI-first world. We are keeping the core infrastructure as part of this agreement, which enables us to keep innovating and delivering the bandwidth, performance, and security our business clients demand.”

“This is a once-in-a-generation opportunity, we’re building a digital networking business that supports today’s AI demands and will be ready for quantum computing tomorrow,” said Kate Johnson.Kate Johnson, Lumen’s president and CEO, described the transaction as a strategic move that aligns with the company’s long-term vision. “We are focusing more on enterprise clients, and this deal increases our financial flexibility, allowing us to reimagine networking for enterprises in a multi-cloud, AI-first world. We are keeping the core infrastructure as part of this agreement, which enables us to keep innovating and delivering the bandwidth, performance, and security our business clients demand.”

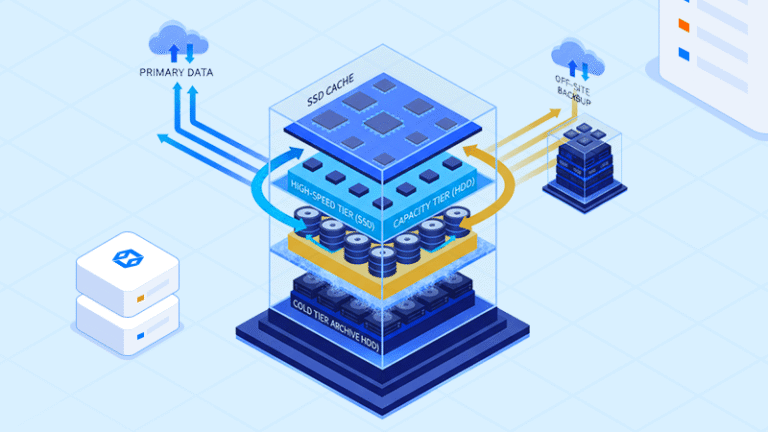

Although AT&T now owns the bulk of Lumen’s FTTH operations, including approximately 95% of Quantum Fiber assets, Lumen retains essential components that will support its enterprise-centric evolution. These include central offices, key real estate holdings, and the complete national, regional, and metro fiber backbone infrastructure. Lumen will also maintain and service its legacy copper network, which continues to serve a segment of its consumer base.

The financial benefits of the transaction are considerable. Lumen plans to use roughly $4.2 billion in net proceeds, combined with existing cash reserves, to retire approximately $4.8 billion in superpriority debt. The reduction in debt is expected to lower annual interest expenses by about $300 million. Additionally, the company’s net debt to adjusted EBITDA (aEBITDA) ratio is projected to decline from 4.9x to 3.9x based on 2025 forecasts.

Beyond immediate balance sheet improvements, the sale is expected to enhance free cash flow by reducing fiber-related capital expenditures by around $1 billion annually. This shift allows Lumen to redirect resources toward its enterprise services division, positioning the company for accelerated investment and innovation.

AI-Focused Networking Contracts

Lumen Technologies has already made headway in its enterprise pivot, having signed $8.5 billion in AI-focused networking contracts with hyperscale clients. The company is targeting a total of 47 million intercity fiber miles by 2028, underscoring its ambition to become a central player in next-generation networking. As part of this effort, Lumen will continue developing its Lumen Digital platform to provide streamlined, secure, and user-friendly enterprise networking services.

Lumen is also investing in emerging infrastructure solutions such as Direct Fiber Access (DFA), Cloud On-ramps, and Multicloud Gateways. These technologies are designed to enhance the integration of physical and digital network layers, delivering greater performance, capacity, intelligence, and security to enterprise customers.

“This is a once-in-a-generation opportunity,” said Kate Johnson. “We’re building a digital networking business that supports today’s AI demands and will be ready for quantum computing tomorrow. The infrastructure we’re retaining is vital to this future, and this deal represents a foundational step in our strategy.”

The transaction is expected to fully close in the first half of 2026, subject to customary closing conditions and regulatory approvals. Lumen was advised on the transaction by JP Morgan Securities LLC and Goldman Sachs & Co. LLC, with legal counsel provided by Latham & Watkins LLP. Strategic advisory services were furnished by Teneo and FTI Consulting.