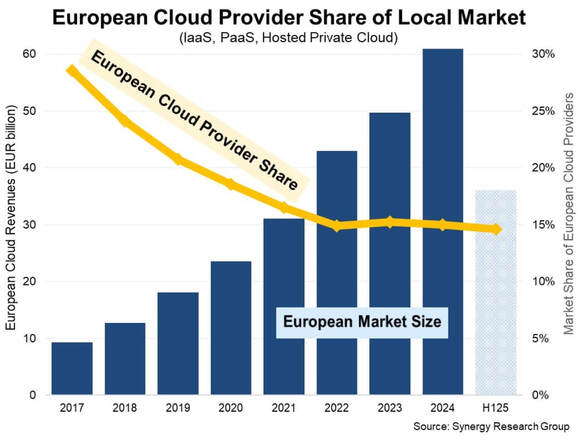

From 2017 to 2024, European service providers more than quadrupled their local cloud revenues, according to new data from Synergy Research Group. The European cloud market, on the other hand, expanded sixfold over that time, reaching €61 billion (US$70 billion) in 2024.

The market share of European cloud providers fell from 29% in 2017 to 15% in 2022, although it has remained mostly stable at 15% ever since. Amazon, Microsoft, and Google have benefited most from the market expansion. Currently, 70% of the regional market is accounted for by these three top worldwide cloud providers.

With 2% of the European market, SAP and Deutsche Telekom are the two largest cloud providers in Europe. Telecom Italia, Orange, OVHcloud, and several more national and regional players come next. The smaller cloud providers in the US and Asia make up the remaining portion of the European market.

According to Synergy Research, the first half of 2025 saw €36 billion in income from cloud infrastructure services in Europe, comprising IaaS, PaaS, and hosted private cloud services. Full-year 2025 sales are expected to increase by around 24% over 2024. The majority of the industry is made up of public IaaS and PaaS services, which are expanding at a faster rate than hosted private cloud services.

Cloud in the UK and Germany

According to Synergy Research, the market is increasingly being driven by AI; generative AI-specific services like GPUaaS and GenAI PaaS have grown by 140-160%. The UK and Germany have the biggest cloud markets in Europe, although Ireland, Spain, and Italy are the major areas with the fastest growth rates.

Aspiring leaders in the cloud market must make significant financial wagers, have a long-term perspective on investments and profitability, remain focused on their goals, and continuously attain operational excellence since it is a game of scale.

John Dinsdale, a Chief Analyst at Synergy Research Group, stated, “The market is one where the five leaders are all US companies, and no European companies have come close to that set of criteria. Any company that wants to truly challenge their market supremacy would find it hard to overcome the €10 billion that US cloud providers continue to invest in European capital expenditure plans on a quarterly basis. As a result, European cloud companies have mostly positioned themselves to serve local client groups with particular local demands, occasionally collaborating with major US cloud providers. Even if a lot of European cloud providers will keep expanding, their proportion of the European market is not going to change much.”